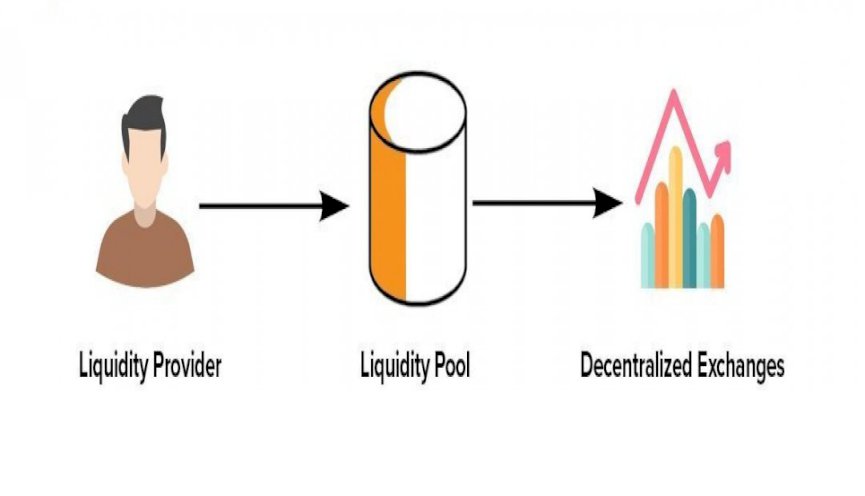

What if markets don’t need a buyer and a seller to exchange two assets for a given price? This is where liquidity pools comes into play. Liquidity pools allows exchange to happen with limited slippage even for the most liquid crypto pair, as long as there is a big adequate liquidity pool. A liquidity pool is a collection of funds locked in a smart contract.

Liquidity Pools are an fundamental part of automated market makers (AMM), yield farming, borrow-lend protocols, tokenized derivatives, blockchain insurance, blockchain gaming, decentralized trading and lending.

Now the question is: how can anyone create liquidity pool ? (hell yeah, no question about who can create as we are in decentralized crypto currency world )

The funds available in the liquidity pools are provided by other users who also earn passive income(yes passive income possible in Decentralized Finance (DeFi) ) on their deposit through trading fees based on the ratio of the percentage of liquidity pool that they provide.

Bancor started using liquidity pool, but the concept gained popularity with gain of Uniswap. Popular exchanges that use liquidity pools are PancakeSwap, ApeSwap, SushiSwap, Curve, Balancer , BakerySwap, and BurgerSwap.